fundamentals of insurance textbook pdf bc

Download the comprehensive Fundamentals of Insurance textbook PDF for free. Perfect for students in BC, Canada.

Insurance is a system for managing financial risk, providing protection against unforeseen events. It plays a crucial role in ensuring financial stability and security for individuals and businesses. Risk spreading, loss prevention, and indemnity are core principles that underpin its function. Understanding insurance fundamentals is essential for making informed decisions about coverage and policies.

The Fundamentals of Insurance textbook and resources like Quizlet offer comprehensive insights into key concepts, including types of insurance, risk management strategies, and the appraisal process. These tools are vital for preparing for exams and building a strong foundation in insurance knowledge.

1.1 What is Insurance?

Insurance is a system designed to manage and mitigate financial risk by providing protection against unforeseen events. It involves pooling resources to compensate individuals or businesses for specified losses. The primary purpose of insurance is to offer financial security and stability, ensuring that policyholders are safeguarded against potential risks. Key principles include risk spreading, indemnity, and loss prevention, which form the foundation of this financial tool.

1.2 Importance of Insurance in Financial Risk Management

Insurance is vital for managing financial risk by providing protection against unforeseen events; It ensures financial stability by compensating for losses, allowing individuals and businesses to recover quickly. This system supports economic activities by enabling investment and growth, as it mitigates potential risks that could otherwise lead to financial devastation.

By spreading risk among a pool of policyholders, insurance reduces uncertainty and provides peace of mind. It also plays a role in loss prevention through safety measures and guidelines, ultimately safeguarding assets and fostering long-term financial security for individuals and organizations alike.

Fundamental Principles of Insurance

Insurance operates on principles like insurable interest, indemnity, good faith, subrogation, double insurance, and reinsurance. These principles ensure fairness, transparency, and sustainability in risk management.

2.1 Insurable Interest and Indemnity

Insurable interest requires policyholders to have a financial stake in the insured asset, ensuring genuine loss exposure. Indemnity, a core principle, aims to restore policyholders to their pre-loss financial state, preventing profit from claims. These principles ensure fairness, aligning insurance payouts with actual losses and maintaining contractual integrity. They form the backbone of ethical and sustainable insurance practices, protecting both parties involved in the agreement.

2.2 Good Faith and Subrogation

Good faith ensures transparency and honesty between insured and insurer, requiring accurate information exchange. Subrogation allows insurers to seek recovery from third parties responsible for losses, protecting policyholders’ rights. These principles uphold trust and fairness, ensuring claims are handled justly and preventing unjust enrichment. They are vital for maintaining integrity in insurance contracts and fostering long-term relationships between providers and clients.

2.3 Double Insurance and Reinsurance

Double insurance occurs when multiple policies cover the same risk, potentially leading to overcompensation. Reinsurance allows insurers to transfer portions of their risk to other companies, enhancing financial stability and reducing liability. Both concepts balance risk distribution, ensuring sustainable coverage for policyholders while managing insurer exposure. They are essential for maintaining the viability and resilience of insurance markets.

Types of Insurance

Insurance is categorized into life, property and casualty, and health and long-term care. Each type addresses specific risks, ensuring tailored protection for individuals and businesses. Proper coverage selection is vital for managing unforeseen events effectively.

3.1 Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the insured’s death. It offers income replacement, covers funeral expenses, and ensures outstanding debts are settled. Permanent and term life policies are available, catering to different needs. This coverage is essential for safeguarding families and ensuring long-term financial stability. Understanding life insurance is a key component of the fundamentals of insurance education.

3.2 Property and Casualty Insurance

Property and Casualty Insurance covers damages to property and liability for injuries or damage to others’ property. It includes home, auto, and commercial policies, protecting against risks like theft, accidents, and natural disasters; This insurance is vital for safeguarding assets and ensuring financial stability in the face of unforeseen events. Understanding these policies is crucial for effective risk management.

3.3 Health and Long-Term Care Insurance

Health and Long-Term Care Insurance provides financial protection against medical expenses and prolonged care needs. Health insurance covers hospital stays, treatments, and preventive care, while long-term care insurance supports individuals requiring extended assistance with daily activities. These policies ensure access to necessary care without depleting personal resources, offering peace of mind and financial stability during challenging times.

The Role of the Fundamentals of Insurance (FOI) Exam

The FOI exam is the first step toward obtaining an insurance license in provinces like BC, MB, and SK. It covers essential concepts, preparing individuals for careers in insurance brokerage, ensuring a solid understanding of industry principles and practices.

4.1 Overview of the FOI Exam

The FOI exam is the first step in obtaining an insurance license in BC, MB, SK, and Atlantic provinces. It covers foundational insurance concepts, including risk management, types of insurance, and legal principles. The exam is essential for aspiring insurance brokers, ensuring they understand the industry’s core principles and practices. Completion of the exam is a prerequisite for advanced certifications like CAIB 1.

4.2 Eligibility and Requirements for the Exam in BC

To be eligible for the FOI exam in BC, candidates must meet specific requirements. Typically, applicants must be at least 18 years old and a Canadian resident. Completion of the Fundamentals of Insurance textbook is mandatory, with the current edition required. Registration involves submitting the FOI Registration Form and paying the fee, which includes the textbook and exam enrollment. Proper documentation and meeting deadlines are essential for a smooth process.

Key Functions of Insurance

Insurance serves to spread risk, protecting individuals and businesses from financial loss; It also plays a role in loss prevention and provides investment capital, fostering economic stability and growth.

5.1 Risk Spreading and Loss Prevention

Insurance enables risk spreading by pooling risks from many policyholders, ensuring financial losses are shared broadly. This mechanism reduces individual burden and provides stability. Additionally, insurance promotes loss prevention through safety measures and risk assessments, aiming to minimize potential damages. These functions ensure sustainable protection and foster economic resilience for individuals and businesses alike.

5.2 Providing Employment and Investment Capital

Insurance fosters economic growth by creating employment opportunities in roles like brokers, underwriters, and claims adjusters. It also generates investment capital by pooling premiums, which are reinvested into infrastructure, bonds, and stocks. This dual role supports job creation and stimulates economic activities, making the insurance industry a vital contributor to financial stability and development. Its impact extends beyond risk management to broader economic benefits.

The Appraisal Process in Insurance Disputes

The appraisal process in insurance disputes involves an impartial assessment to resolve disagreements between the insured and insurer, ensuring fair settlement or coverage determinations.

6.1 Purpose of the Appraisal Process

The appraisal process aims to resolve disputes between the insured and insurer regarding the amount of a settlement or coverage denial. It provides an impartial assessment to ensure fair and reasonable outcomes, maintaining trust and transparency in insurance transactions. This process helps avoid lengthy legal battles and ensures both parties reach a mutually acceptable resolution.

6.2 Resolving Disputes Between Insured and Insurer

The appraisal process is a structured method to resolve disputes between the insured and insurer, primarily regarding settlement amounts or coverage issues. It involves impartial assessment by a neutral third party to determine fair outcomes. This approach helps avoid costly legal battles and ensures both parties reach a mutually acceptable resolution, fostering trust and maintaining the integrity of the insurance relationship.

Purchasing the Fundamentals of Insurance Textbook

The current edition of the Fundamentals of Insurance textbook is available for $165. To order, download and complete the registration form, then submit it via email as instructed.

7.1 Ordering the FOI Textbook

To order the Fundamentals of Insurance (FOI) textbook, download and complete the FOI Registration Form. Submit the form via email to the provided address. Ensure all required fields are filled accurately, including personal and payment details. The current cost is $165. Upon submission, allow time for processing. Confirmation and delivery details will follow. This step is essential for obtaining the necessary study materials.

7.2 Cost and Payment Methods

The Fundamentals of Insurance (FOI) textbook costs $165. Members receive a discounted rate of $110, while non-members pay the full price of $160. Payment can be made via credit card (Visa, MasterCard, or Amex), cheque, or bank draft. Ensure payment is submitted with the registration form for processing. Additional fees may apply for shipping or handling, depending on the delivery location.

Glossary of Insurance Terms

The Glossary of Insurance Terms provides essential definitions for beginners. Priced at $40.00, it clarifies key concepts, making it a valuable resource for students of the Fundamentals of Insurance.

8.1 Essential Definitions for Beginners

This section introduces key insurance terms, such as insurable interest, indemnity, and subrogation. It defines spread of risk and explains how insurance protects against losses. Terms like premium, deductible, and policyholder are also covered, providing a clear foundation for understanding insurance concepts.

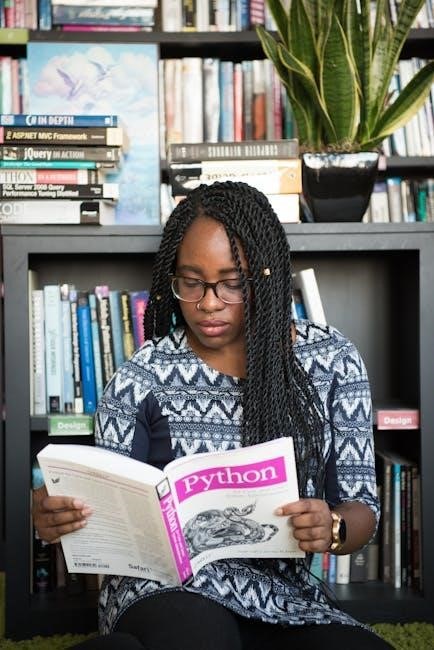

Study Resources for the Fundamentals of Insurance

Utilize Quizlet flashcards and practice questions to reinforce key concepts. Additional materials, such as textbooks and online guides, provide comprehensive support for exam preparation and understanding insurance principles.

9;1 Quizlet Flashcards and Practice Questions

Quizlet flashcards are an excellent tool for memorizing key insurance terms and concepts. They cover topics like the purpose of insurance, risk spreading, and loss prevention. Practice questions help reinforce understanding of fundamental principles, such as insurable interest and indemnity, ensuring readiness for the Fundamentals of Insurance exam.

These resources are designed to simplify complex ideas, making studying more efficient. They align with the Fundamentals of Insurance textbook, providing a comprehensive review of essential topics and exam preparation strategies.

9.2 Additional Materials for Exam Preparation

Beyond the Fundamentals of Insurance textbook, students can access additional resources like study guides, video tutorials, and practice exams. These materials help deepen understanding of key concepts and exam formats.

Supplementary tools such as flashcards, glossaries, and interactive quizzes provide hands-on practice, ensuring comprehensive preparation for the exam. They also offer flexible learning options to suit individual study preferences and needs.

Insurance and Risk Management Strategies

Insurance plays a vital role in managing risks by providing financial protection against unforeseen events. It enables individuals and businesses to mitigate potential losses effectively, ensuring stability and security.

10.1 Assessing and Mitigating Risks

Assessing and mitigating risks are fundamental processes in insurance. Identifying potential risks and evaluating their impact helps in implementing effective strategies to minimize losses. Risk spreading and loss prevention are key concepts, ensuring that individuals and businesses are protected against unforeseen events. By understanding these principles, one can make informed decisions about insurance coverage and policies.

Insurance policies play a crucial role in mitigating risks by providing financial protection. Strategies like diversification and risk transfer ensure that losses are managed effectively. The appraisal process also aids in resolving disputes, further solidifying risk management practices. Quizlet flashcards and study materials offer insights into these strategies, helping individuals master the fundamentals of risk assessment and mitigation.

Understanding the fundamentals of insurance is essential for managing risks and ensuring financial security. The Fundamentals of Insurance textbook provides a comprehensive guide to key concepts, enabling informed decisions about coverage and policies. Mastery of these principles, supported by resources like Quizlet, empowers individuals to navigate the complexities of insurance effectively.

11.1 The Importance of Understanding Insurance Fundamentals

Understanding insurance fundamentals is crucial for effective financial planning and risk management. It equips individuals with the knowledge to make informed decisions about coverage, ensuring protection against unforeseen events. The Fundamentals of Insurance textbook and resources like Quizlet provide essential insights into key concepts, enabling individuals to navigate the complexities of insurance with confidence. This knowledge is vital for both personal and professional financial security.